operating cash flow ratio ideal

Both manufacturers and retailers list cost of good sold on the income statement as an expense directly after the total revenues for the period. More How Working Capital Turnover Works.

Operating Cash Flow Defined Aimcfo

Cash Flow from Operating Activities Sales Ratio.

. The current ratio is a liquidity ratio that measures a companys ability to cover its short-term obligations with its current assets. Creditors and investors also use cost of goods sold to calculate the gross margin of the business and analyze what percentage of revenues is available to cover operating expenses. If a companys financial leverage ratio is excessive it means theyre allocating most of its cash flow to paying off debts and is more prone to defaulting on loans.

In tandem with the previous analysis of a stable cash flow from operating activities you want to look at the trend of cash flow from operating activities divided by sales aka revenue. If a companys current ratio is in this range then it generally indicates good short-term financial strength. A lower financial leverage ratio is usually a mark of a financially responsible business with a.

If the debt-service coverage ratio is too close to 1 for example 11 the entity is vulnerable and a minor decline in cash flow could render it unable to service its debt. If the value of a current ratio is considered high then the company may not be efficiently using its current assets specifically cash or its short-term financing options. The ideal scenario is that CFO is increasing steadily and the CFO sales ratio has also been stable.

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

Cash Flow Formula How To Calculate Cash Flow With Examples

Operating Cash Flow Ratio Definition And Meaning Capital Com

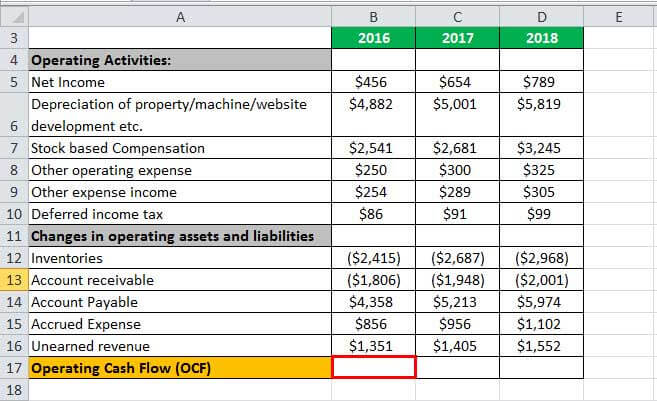

Operating Cash Flow Formula Calculation With Examples

Cash Flow Ratios Calculator Double Entry Bookkeeping

Operating Cash Flow Formula Calculation With Examples

Price To Cash Flow Formula Example Calculate P Cf Ratio